Is Lexington Law Credit Repair Legit

Pros

- Offers coaching to encourage good credit behaviors

- Leverages each angle of the police force for improve success

- Known for fast and effective disputes

- Monitors each aspect of the service through the app

- Offers defended focus tracks to deal with life events such as divorce

Cons

- Packages have become expensive

- No service guarantee or refund policy

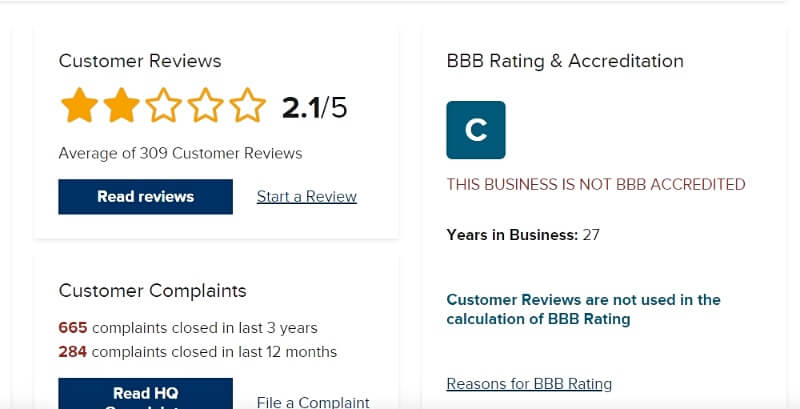

- Not BBB Accredited

Almost Americans are nether some form of debt and some are struggling to get rid of it. In such times, the ability to repair your credit and become items off your written report comes every bit a blessing. Yet, very few know how to dissect a credit written report and most need the help of a credit repair company.

You volition find several credit repair businesses out there, today nosotros'll review Lexington Law that aims to make life easier by improving your credit. In this Lexington Police review, we'll accept an in-depth look at Lexington Law firm including Lexington Police force payments, plans, and credit repair services.

The business firm has been operating for a long time and has carved a niche. It is one of the most reliable names. In fact, you will find a lot of positive Lexington Law reviews on the Internet. The general consensus seems to be positive, but is it really worth the coin? Nosotros'll find out in this Lexington Police credit repair review.

What is Lexington Police force?

Founded in 2004, Lexington Police is a credit repair firm with thousands of success stories. Information technology can remove judgments and help improve your credit score.

Unlike other credit repair firms, Lexington Police has been founded by qualified lawyers who know the industry well. The establishment is transparent almost the lawyers it has on its team. John Heath is the directing attorney, a position he has held since 2004 when the business firm started specializing in representing clients in the area of credit repair. In Lexington Constabulary reviews, people likewise mention receiving help from the team of paralegals, who offer communication and help lawyers perform other tasks such as legal research.

They're aware of federal and financial standards and enjoy a high success rate. Co-ordinate to our research, the boilerplate client gets 10.2 negative items removed from their study. This is pretty good when compared to competitors. Moreover, the house offers some additional credit repair-related services that make it a cracking option for people looking to ameliorate their credit scores.

You can receive assist remove the following:

- Collections

- Charge offs

- Late payments

- Bankruptcies

- Lines

- Repossessions

- Incorrect information

While the Lexington Law firm is reliable, we must mention that it simply helps remove inaccuracies.

How to get in affect with Lexington Law'southward Customer Service

Lexington Law's customer service is top-notch. Nearly Lexington Law testimonials hold that agents are friendly and informed.

Lexington Law hours:

Reps tin can exist contacted via phone 12 hours a day, 5 days a week from 7 a.one thousand. to 7 p.m. MST.

Lexington Constabulary address:

360 N Cutler Drive

North Salt Lake, UT 84054

U.S.A.

Other options include electronic mail and social media. Sadly, no live chat feature is bachelor to contact Lexington Law firm client service.

How does Lexington Police work?

Lexington Police uses a elementary iv-step procedure. Information technology's attorney-backed, and the firm utilizes patented technology to reduce its reliance on the post organization, which is a bit irksome.

Mail-based disputes take approximately 45 days to get resolved. The Fair Credit Reporting Human activity allows xxx days for information furnishers to respond to bureau challenges. A further 15 days is taken up in mailing communications.

In some Lexington Law credit repair reviews, past clients have expressed seeing results in as little as xxx days. The attorney-led repair house leverages every legal angle, and each customer receives a personalized strategy.

#1 Access and Analyze Your Credit Study

In the start pace, Lexington'southward lawyers will go in touch with the bureaus, obtain and review your credit written report to find any inaccurate or negative information. To make things easier, you will exist assigned a paralegal during this stage to answer your questions and communicate with you. This is a great feature considering having a dedicated paralegal or account manager makes things easier.

#2 Place and Dispute Incorrect Items

Once negative items accept been identified and reviewed, the team will draft and send correspondence including dispute letters to your original creditor or credit bureaus on your behalf. The purpose is to inform the other party that there may be issues on your report and to review it.

The team volition provide proof to the other party and the result may go resolved at this stage. However, in some cases, a niggling more than fourth dimension and work may exist needed.

#three Escalate and Follow Up

Some cases can be complicated and require follow-up. If such is the instance, Lexington Law will arrive touch with a creditor or bureaus to escalate things. More correspondence may be required at this phase.

#4 Ongoing Mentoring and Alerts

You lot volition receive regular alerts if you have called a packet that includes monitoring services. The Lexington Law firm sends alerts via message or phone whenever in that location are changes in one's credit score, positive or negative. This service can be of help in maintaining your score over fourth dimension.

Pros and Cons of Lexington Law

Here are some of the main pros of using Lexington Police force:

- Lexington Law firm app is client-friendly and very well fabricated.

- The system offers a free consultation to new clients, which tin be great for users who want to know more than about their financial history. The costless offer includes recommendations, a summary, and a credit score check.

- Different most companies in this field, Lexington Police force prices are very transparent with no upfront charges.

- The house houses qualified lawyers with experience in credit repair. This gives it an edge over competitors.

- Thank you to their partnership with Progrexion, Lexington Law leverages patented engineering science to file disputes faster.

- Personalized services are offered, which entails assigning a paralegal to every case. You volition work with the same person throughout the process.

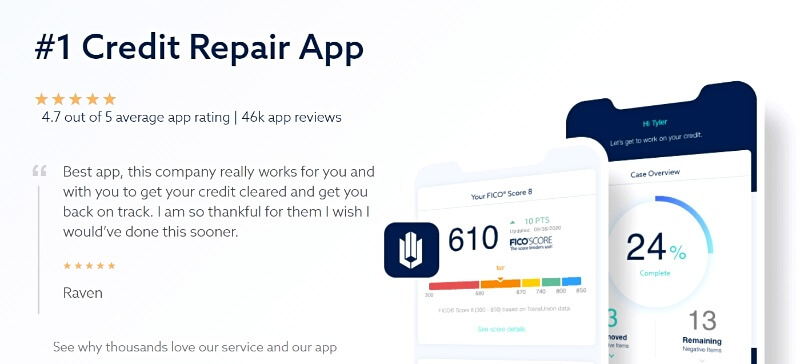

- Most Lexington Law customer reviews are highly positive and clients seem to be happy with the house results.

Reviews for Lexington Law cannot be consummate without cons. Here are some:

- While the credit repair provider offers three plans, the cheapest plan, which starts at $89.95 per month, is notwithstanding more expensive than what competitors are offering.

- At that place is no money-dorsum guarantee provided. This ways you will get no refunds even if at that place are no wrong items on your study or if the firm fails to remove whatever.

- The firm seems to accept an average BBB rating of C. However, according to the organization, the rating isn't a truthful reflection of its performance and is due to BBB's bias towards the industry.

- Credit Repair Services in Oregon and Due north Carolina are not available.

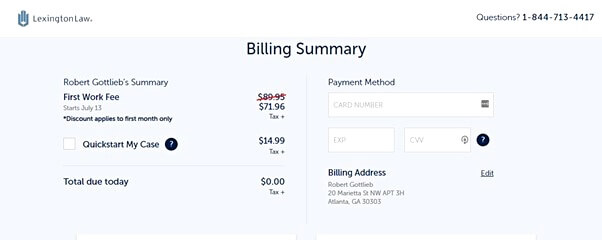

- It doesn't thing which plan you choose, you will have to pay a $14.95 quickstart fee.

Proficient reviews of Lexington law

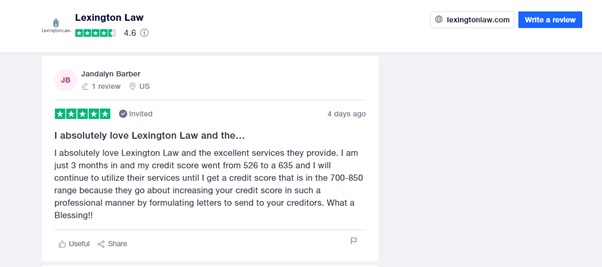

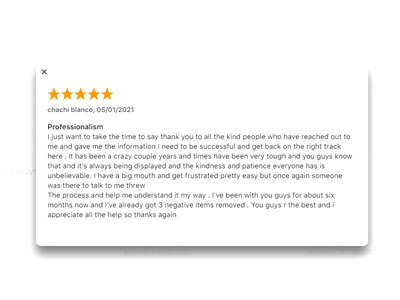

During our Lexington Law review, it stood out that nigh customers appreciate and admit the help they received from the business firm. There were many sources for independent and verified Lexington Constabulary credit repair reviews from by customers, including the App Store, Play Store, and TrustPilot.

In this featured Lexington Police force review, the client said that he loved working with the firm. His score improved from 526 to 635.

Another reviewer commended the firm by stating that they received the information needed to get back on track, and the reps were patient in explaining how it works. He had about three negative item deletions. Their credit repair app has so far received a 4.8 score on the Apple Store.

Lexington Law complaints

It's a given that some customers volition non be happy with the quality of services rendered. Rather than dwelling on the issues raised equally they are non common to all customers, nosotros checked how Lexington Police responded to complaints.

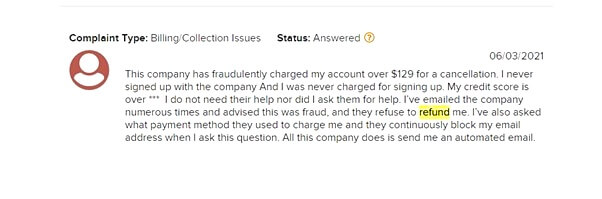

In one detail case brought forward by a client on 06/03/2021, they complained well-nigh their account beingness fraudulently charged. The client also complained most not receiving a refund even after emailing the firm several times.

Their administrative assistant replied about 14 days later, on 06/xiv/2021. In response, the Business firm stated that the client had engaged in their services on March fifteen, 2021. They expressed that they don't guarantee results and they don't offer whatsoever refund policy. The response further stated that an attorney had reviewed the complaints and would undertake further steps to resolve the result.

At that place are few cases where customers receive refunds from the firm after raising a complaint on BBB.org. Responses to complaints seem to be more than formal than other reviewed services that seem to accept a more personal approach and may be open to issuing refunds. Still, virtually reviews on Lexington Police force receive a response, whether they are positive or negative.

When gauging whether their services are suitable, you may go the extra mile and check Lexington credit repair reviews to see both sides of the story.

Lexington Constabulary Plans

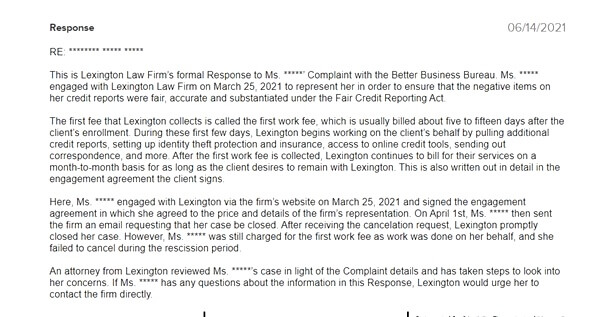

There are iii different plans offered, ranging from regular to premium plans. The plans are created neatly, which means you will pay but for the Lexington Police force services that you crave.

Agree Standard

Concord Standard is for users interested in a basic plan. It covers only the basics and comprises a multifariousness of services including creditor interventions and credit disputes. The credit disputes process deserves special mention as it involves identifying issues on your report. These problems are reported to the credit bureaus for review and removal.

On the other hand, interventions are unlike correspondence types the concern sends to collection agencies and lenders on your behalf. Some examples include debt validation and goodwill letters. The former refers to letters that evidence that the money you owe is invalid and the latter refers to letters sent to lenders to finish them from reporting late payments if you have a decent payment history.

Concord Premier

The mid-tier plan comes with everything from the bones plan and more. If you lot choose this programme, simulated hard inquiries on your credit report will exist disputed. In addition to this, you will receive a complete credit score assay to aid you lot empathise your financial situation.

Moreover, this plan includes monitoring services with the option to receive alerts if there are any changes in your score. This can be a dandy programme for users who want to be fully enlightened of what'south happening with their credit report without having to pay heavy charges.

PremierPlus

The premium expensive plan includes all the services included in the previous ii plans and some more than. Information technology comes with a unique service called 'stop and desist letters,' which can be used to stop creditors from harassing you. This can be a great pick for people who practice not want to receive intrusive calls or who take a lot of creditors to deal with.

With this, you will besides get identity theft protection and access to some financial planning tools including a FICO score tracker.

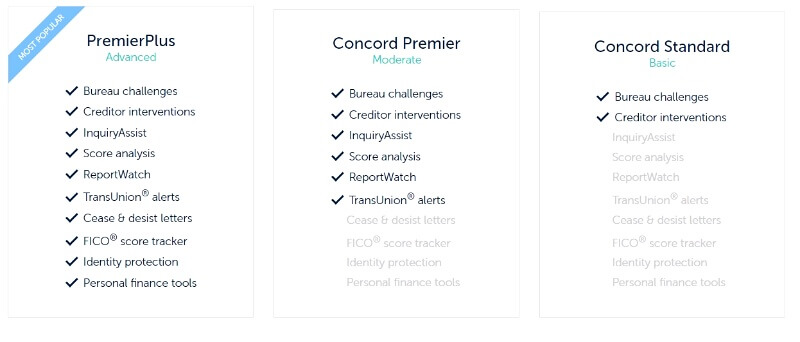

Lexington Law Prices

Similar other companies in this niche, Lexington Police force charges an initial work fee. Information technology varies depending on the selected pricing programme. For case, PremierPlus goes for $129.95, and it has a respective initial setup fee of $129. Concord Premier goes for about $109.95, and Agree Standard will set customers back by $89.95. Both plans have corresponding setup fees of $109.95 and $89.95.

The Credit Repair Organizations Act prohibits firms from charging their initial review fee earlier rendering any services. So, it'southward not billed correct away. They country that they will charge it against the client's preferred billing method afterwards five to 15 days, generally after preparing and sending the first circular of disputes.

When budgeting for the first month of service, consider that you may need to pay about $258 for PremierPlus, $219 for Concur Premier, and $179.9 for Concord Standard. There's an optional fee of $fourteen.99 that customers can pay to accept their case quick-started. The payment is made to their partner visitor Credit.com, and this allows them to load customer credit reports from TransUnion into their system. Some professional Lexington Law reviews claim that the fee is mandatory, but this is false.

When conducting our Lexington Law firm review, we discovered that they were offering discounts on their get-go month'south piece of work fee. For case, the initial review fee was discounted from $89.95 to $71.86 for the offset month's fee on the Concord Standard plan.

Nosotros cannot confirm that this discounted Lexington Law toll will exist in effect when yous sign upwardly. It'due south not also possible to ascertain if Lexington Law offers are applicative to residents of all states.

The website also doesn't mention the Lexington Law monthly fee for the second programme. You will encounter it when you go along the Lexington Constabulary sign-upwards page.

Lexington Law Alternatives

Here are some of the other companies that can help you remove evictions and other problems:

Lexington Law vs Sky Blue

Sky Blue is a major name and also one of the oldest providers of credit fixing services. They take the upper hand when it comes to affordability every bit their package merely goes for $79, which is fifty-fifty cheaper than the Hold Standard Bundle.

While the fee is relatively cheaper, their packet lacks FICO score tracking and daily TransUnion credit report updates. They also don't provide the aforementioned personal finance tools available on the Lexington Law iOS and Android apps.

Lexington Law vs The Credit Pros

The Credit Pros is new in the game but is known for its first-class value. Their customers piece of work on a i-to-one basis with FICO-certified experts, while Lexington Law customers receive help from a team of legal assistants.

Both platforms are well-matched when information technology comes to technology as they all provide apps. They besides offer ID protection and credit monitoring.

Information technology'southward worth noting that The Credit Pros has a bundle priced at only $69 per calendar month. Hither's a further comparison:

Lexington Constabulary vs Credit Saint

Credit Saint came out the aforementioned yr every bit Lexington Law skyrocketed and offers three plans. Information technology has not been forthright with its results, although it has garnered many positive reviews. On the other hand, it's like shooting fish in a barrel to find Lexington Law results on their homepage. For case, they have managed over 70 million removals after working on customer credit reports. The firm too leverages modern applied science to file client disputes faster, while Credit Saint reveals that they yet rely on a mail service-based dispute system with disputes cycles lasting for up to 45 days. Hither'southward a further comparison:

BBB Rating: C

Setup fee: $89-$129

Monthly fee: $90-$130

FAQ

Lexington Law does not ask for long-term contracts and most jobs crave six months to complete. All the same, some less circuitous jobs can be completed in less time. The firm charges a monthly fee with the selection to abolish anytime past getting in touch with the agents. According to the official site, Lexington Law removes about 24 percent of negative items from the boilerplate client's report.

The business firm has a C rating with 7 CFPB complaints and over 600 BBB complaints in the final three years. Lexington Law ratings testify that it enjoys a decent score and can remove charge-offs.

Overall, Lexington Police force's reputation is adept. The apps are rated four.5 on AppStore and Google Play and the trust airplane pilot score is besides iv.5, which is pretty good. Information technology does have a mixed BBB score but nigh credit repair companies in this niche do not seem to savour a high BBB rating.

Lexington might appear expensive on newspaper since its cheapest program of $89.85 is college than what other companies charge. Even so, they are notwithstanding affordable than law firms that offering customers the opportunity to work with real lawyers and, in return, charge thousands of dollars for the "privilege."

The service doesn't offer add-ons at the moment and your only selection is to cull a programme that fits your needs. I major concern, however, is the quickstart fee.

There isn't much about this fee on the official website. Y'all volition not see a mention of the fee until you start the Lexington Law sign-up process. Co-ordinate to the official site, this fee is shared with third parties just the house doesn't mention if it helps expedite the process and there doesn't seem to be the option to avoid information technology.

Yes, Lexingtonlaw.com tin can remove late payments, questionable collections, evictions, or judgments. The business is legitimate with a good history. If you ask us 'is Lexington Law legit?' we'll say that it is. Information technology is, in fact, good and reliable. The constabulary firm has carved a niche by offering decent services and has handled millions of cases since its inception.

Is Lexington Police a Good Credit Repair House?

Lexington Police force makes information technology to the list of best credit repair companies for a variety of reasons. Information technology is one of the few providers to house real lawyers and paralegals who may assistance with credit repair or debt consolidation. It makes it like shooting fish in a barrel to keep track of whatsoever improvements to your credit after removals by the credit bureaus. They provide updated FICO scores too as TransUnion credit reports through their user portal and apps. However, a lack of a money-back guarantee can be an outcome for some users.

Is Lexington law worth it? Our review concludes that information technology'south a expert provider and not a scam. There are plenty of customer reviews to substantiate the quality services they offer. It may be even cheaper than more personalized and smaller repair firms that may charge thousands of dollars for their intervention.

Source: https://creditrepairpartner.com/lexington-law-review/

Posted by: kennywity1942.blogspot.com

0 Response to "Is Lexington Law Credit Repair Legit"

Post a Comment